If you’ve climbed the mountain of debt repayment, you know how hard the journey can be. But all the meticulous saving, budgeting, and planning in the world is just the first step—if you’ve never examined the underlying reason for the debt in the first place, it’s easy to fall back into toxic patterns. After all, bad habits die hard.

Debt relapse is an all too common pitfall that can derail financial progress and deflate your motivation. That’s why it’s so important to establish good habits that keep you on the path toward success. With the right outlook and a few key strategies, you can dodge the dreaded debt relapse for good.

1. Build an Emergency Fund

Building an emergency fund is step one in any move toward financial stability. A big unexpected event—an injury, a job loss, a leaky roof—can turn into a financial catastrophe in no time flat. If you don’t have any monetary safety net in place, you could end up turning to credit cards and racking up thousands in extra interest payments.

The golden rule for most people is to set aside 3-6 months’ worth of living expenses in a liquid emergency fund. If you’re a high earner, a freelancer with irregular income, or you have other unique life circumstances, consider doubling this amount. Building an emergency fund takes time, effort, and sacrifice, but the protection from financial stress is worth its weight in gold.

2. Tackle Your Credit Card Debt

If you’ve beaten debt once before, you’re likely familiar with the challenge of tackling credit card debt. It racks up quickly and balloons even quicker, all thanks to interest. If you’re noticing your credit card balances are starting to creep back up, it’s time to zero in on aiming for zero. Carrying a balance will only cause the amount you owe to grow faster than you can keep up with it.

Before things spiral beyond your control, it’s time to employ one of two old standbys:

- Avalanche Method: This is a repayment strategy that tackles debts with the highest interest rates first. As you chip away at these debts, you end up saving more money on interest over time.

- Snowball Method: The snowball method pays off small debts first. This motivates you to keep going because quickly getting rid of smaller balances gives a sense of progress.

No matter which strategy you use, be ready to make more than the minimum monthly payments to get the balances back down quickly. It’s absolutely critical that you stay on top of good credit card habits—otherwise, you could find yourself back at square one.

3. Start Paying With Cash

If credit cards are just too tempting, start paying with cash. It may not have the same convenience and consumer protections as credit cards, but for those with spending issues, cash can be an effective debt deterrent.

Why? Because you can only spend what you physically have. Watching the money leave your possession feels a lot more impactful than swiping or tapping a piece of plastic without much thought. Cash stuffing, or envelope budgeting, is a common debt management strategy for those who are getting back on their feet. If you’re finding yourself inching toward a debt relapse, it’s time to give it a try.

4. Nix the Impulse Spending

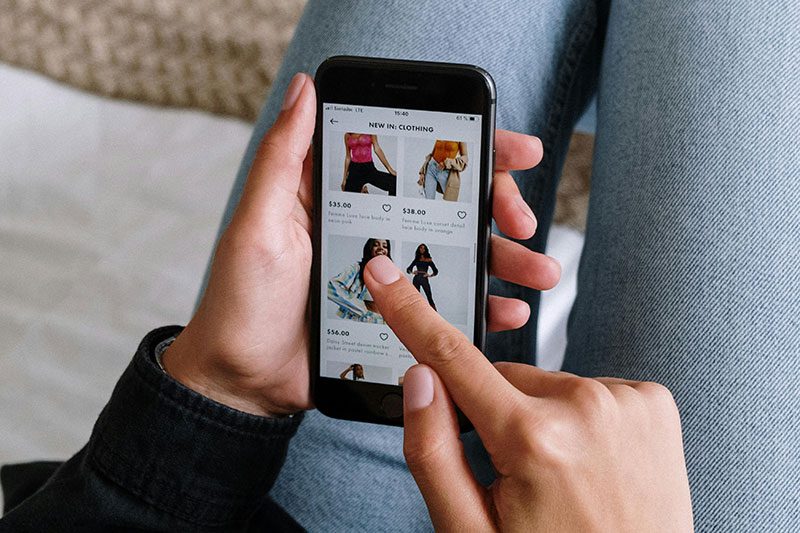

If you’ve been a little lax with impulse buys lately, you may be in danger of a debt relapse. This is a common setback: A 2022 Slickdeals survey found that three out of four respondents admitted most of their purchases were spontaneous.

When you’re shopping impulsively, you’re more likely to tap your credit card in pursuit of a little instant gratification. And, as we know, that’s the start of a dangerous cycle. There are a few things you can implement to curb your spontaneous spending.

Firstly, as mentioned above, start paying with cash so the “sting” of a purchase feels a little more impactful. It’s also a good idea to shop with a list, remove shopping apps from your phone, and implement a waiting period to determine if you really want something after a day, a week, or longer. If you do, then work on making room in your budget for that specific thing.

5. Steer Clear of Your Spending Triggers

Spending triggers go hand in hand with impulse spending. While some buys may be in the heat of the moment, others can be triggered by an emotional state or your environment. It’s best to identify what these triggers are so you can avoid them and work to overcome them.

For example, you may feel compelled to shop when you’re stressed, bored, or down. You may be in a cycle of “keeping up with the Joneses” and trying to impress friends or family. Maybe it’s the holiday season, and you can’t resist a year-end sale. Regardless of what’s feeding the urge, it’s important to interrupt the pattern before it becomes excessive. Stay proactive by setting limits, knowing when to walk away, and asking for help from an expert if needed.

6. Measure Your Progress

Seeing marked progress is one of the biggest motivators in staying debt-free. When you were whittling down your debt, you probably had goals like paying off credit cards, growing your credit score, and freeing up room in the budget. But once you’ve defeated the debt, that doesn’t mean it’s time for the goals to stop.

Your financial journey will always be evolving, and seeing the evidence of what you’ve accomplished is fuel to keep going. Consider making a list of new progress points like maxing your 401(k) contributions, starting a travel fund, or opening a taxable brokerage account.